This is not a post about HDFC Bank’s loan growth, NPAs, CASA or other fundamentals.

This is a post to clear the air around how index providers decide on the weight of stocks in the index - in this specific case, we look at HDFC Bank and the latest shareholding from the close on 31 March 2024 to see how MSCI could view it.

History

HDFC Bank has a Foreign Ownership Limit (FOL) of 74% of its paid-up capital. This was increased from 49% in November 2014.

When foreign investment in the stock crossed its cap of 49% in December 2013, foreign investors could no longer purchase stock in the local market. The company applied to the Foreign Investment Promotion Board (FIPB) for a limit increase to 74%. This was approved in November 2014, but the promoter stake of 22.68% that HDFC held in HDFC Bank was classified as indirect foreign since HDFC Ltd was majority foreign owned. Even post the limit increase to 74%, foreign investors could not buy the stock.

In November 2014, MSCI excluded HDFC Bank from its global market indices since foreign investors could not buy the stock.

In February 2017, the stock was reclassified from the 'breach list' (stocks that were at the FII limit and no further foreign buying was permitted) to a 'red flag list' (stocks that are within 3% of the FII limit and are monitored, but foreign investors can buy). There was a buying frenzy taking the stock back up (and past) its 74% foreign limit.

The stock continued to remain out of the MSCI indices since the foreign room was below the threshold for inclusion in the indexes.

The Big Merger

Exactly 2 years ago (give or take 2 days), HDFC and HDFC Bank announced a mega-merger where HDFC shareholders would receive 42 shares in HDFC Bank for every 25 HDFC shares held.

Apart from the fundamental changes (remember, no fundamentals in this post!), the interesting angle was how index providers would view the merged entity.

At that point, only HDFC was a member of the MSCI India Index.

Foreign investors held 72.16% of HDFC (vs a Foreign Ownership Limit of 100%) and 70.08% of the shares in HDFC Bank (vs a Foreign Ownership Limit of 74%).

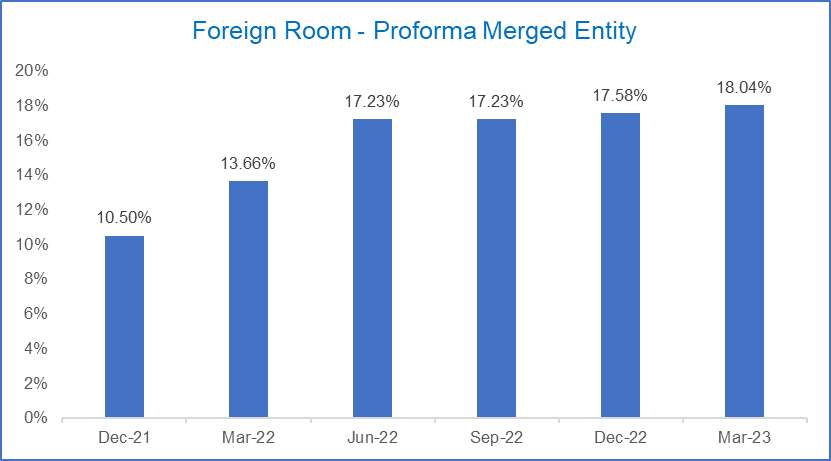

Based on the merger ratio, foreign investors would own 66.24% of the merged entity (due to HDFC’s shareholding in HDFC Bank being cancelled) versus a FOL of 74%, implying 10.5% foreign room.

Foreign room continued to increase as foreign investors continued to sell shares in HDFC and HDFC Bank over the next few quarters.

In May 2023, at the time of merger completion, MSCI announced that HDFC Bank would replace HDFC in the MSCI India Index with an adjustment factor of 0.5 applied since foreign room was less than 25%.

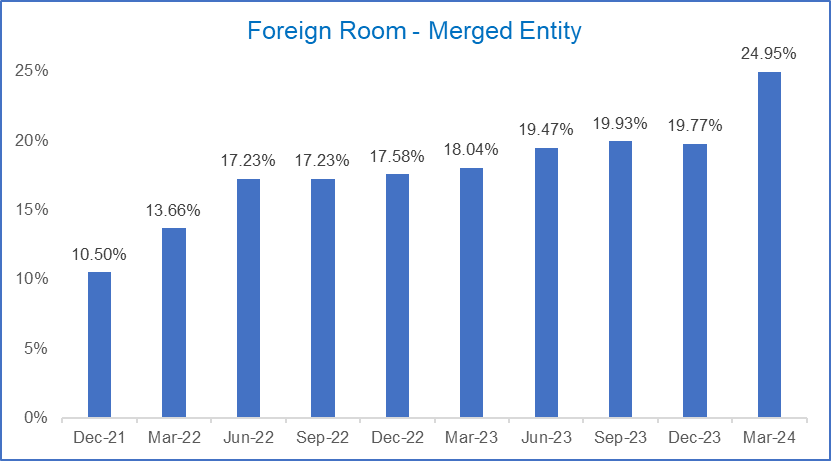

HDFC Bank has continued to remain in the index with the 0.5 adjustment factor resulting in a lower weight for the stock.

Foreign Shareholding

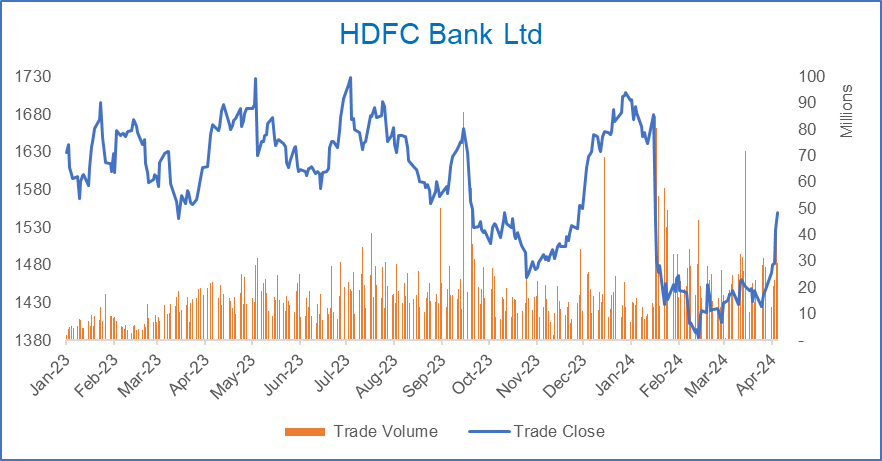

The foreign shareholding in HDFC Bank (proforma pre-merger and actual post-merger) has continued to increase and there was a big jump in the January to March 2024 quarter as FPIs bailed on the stock.

The foreign shareholding was 55.54% (down from 59.37% as of the December 2023 quarter-end) resulting in foreign room of 24.95%.

This is tad short of MSCI’s minimum threshold of 25% for the 0.5 adjustment factor to be removed and for HDFC Bank to be included in the MSCI India Index at its full weight.

The question now is: will MSCI remove the adjustment factor in May since the foreign room is almost there, or will MSCI wait till the foreign room crosses 25% (resulting in an increased index weight in August at the earliest)?

Removal of the 0.5 adjustment factor will require passive trackers to buy around 260m shares (US$4.8bn; 11x ADV) of HDFC Bank. That is huge and is potentially one reason for the recent move higher in the stock.

So, how does MSCI weight stocks?

Index providers look to create indexes that represent the overall market, a sector, a theme, an idea, could be anything.

One of the main objectives is that the index should be investable. For indices that are tracked by global investors, that means the investors should be able to buy/sell stock at any time so there is no tracking error versus the benchmark.

Banks in India have a maximum Foreign Ownership Limit (FOL) of 74%. That could be lower for some banks.

Imagine a bank stock that has 100 shares in issue and all shares are free float. A FOL of 74% means that foreign investors can own 74 shares of the bank.

Once foreign investors own 74 shares, there can be no more foreign buying since the FOL has been reached.

If the MSCI India ETF receives a large creation order, they will not be able to buy the bank stock and will end up with tracking error (which could be sizeable).

To reduce this risk, MSCI and other index providers lower the weight of the stock in the index once the stock starts to near the FOL. Once the FOL is breached, the stock is deleted from the index.

Different index providers have different rules for the timing of index deletion and for timelines and thresholds for the stock to be reincluded in the index (or for the weight of the stock to be increased if the foreign room increases).

Index providers follow a set of rules that use market data (market cap, free float market cap, foreign room, liquidity etc.) to determine which stocks should be included into and deleted from indices. For headline indices, index providers do NOT look at stock fundamentals or make a discretionary judgement on the stock - that is left to the market.

Remember, the role of an index provider is to create indices that are investable and represent the market/ sector/ theme.

With foreign room in HDFC Bank hovering between 18-20%, in line with its rules, MSCI applied an adjustment factor of 0.5 to the stock.

With foreign room now nearly 25%, there is a small possibility of the adjustment factor being removed in May.

More likely is that MSCI will wait for the foreign room to actually cross 25% before making that adjustment. That could happen in August if foreign room crosses 25% at the June quarter-end or in November if foreign room crosses 25% at the September quarter-end.

March-end Shareholding

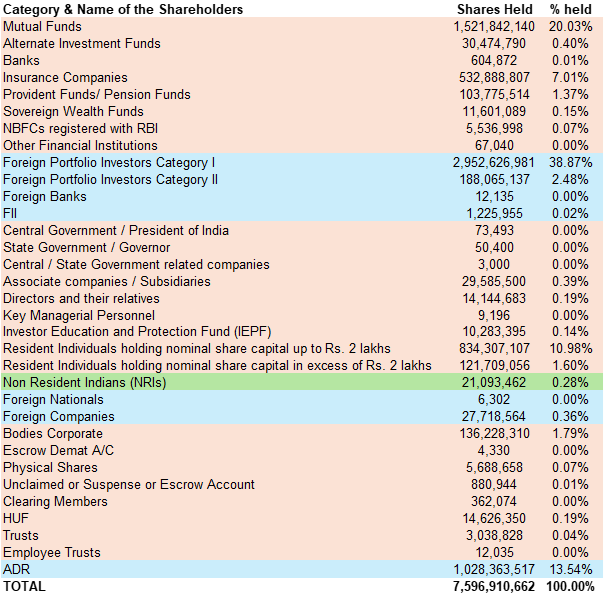

BSE and NSE show the foreign shareholding as 55.54% (foreign room of 24.95%).

Looking at the lines highlighted in blue, we reach 55.26% foreign shareholding (foreign room 25.32%). This means that the entire NRI shareholding (highlighted in green) has been taken as foreign which could be due to funds coming from a repatriable account.

And that difference in foreign room (more than 25% vs less than 25%) could be leading to HDFC Bank stock running up over the last couple of days as investors place bets on passive inflows coming in May.